Repealing Oregon’s EV mandate should be next on Gov. Kotek’s list

By John A. Charles, Jr. Recently Gov. Tina Kotek decided to pull the…

Read Blog Detail

By John A. Charles, Jr. Recently Gov. Tina Kotek decided to pull the…

Read Blog Detail

March 12, 2024 Ms. Julie BrownChairOregon Transportation Commission355 Capitol Street NESalem, OR 97301…

Read Blog Detail

By John A. Charles, Jr. On February 22, the Joint Committee on Transportation…

Read Blog Detail

By John A. Charles, Jr. The last segment of Oregon’s Interstate Highway system…

Read Blog Detail

November 29, 20323 Metro Council600 NE Grand AvenuePortland, OR 97232 Re: Adoption of…

Read Blog Detail

By John A. Charles, Jr. For those of us who came of age…

Read Blog Detail

By John A. Charles, Jr. For the past 30 years, opinion polls have…

Read Blog Detail

By Mia Tiwana Portland’s TriMet transit agency and the Metro regional government have…

Read Blog Detail

September 14, 2023 FOR IMMEDIATE RELEASE Cascade Policy Institute4850 SW Scholls Ferry Rd.,…

Read Blog Detail

By Randal O’Toole Executive Summary The pandemic has made it painfully clear that…

Read Blog Detail

By John A. Charles, Jr. TriMet’s Blue rail line to Hillsboro opened on…

Read Blog Detail

By Micah DeSilva Metro is the regional government of the greater Portland region….

Read Blog Detail

By Sam Herrin Metro’s 2023 Regional Transportation Plan calls for expanding many different…

Read Blog Detail

John A. Charles, Jr.Cascade Policy Institute Submitted to theOregon Transportation CommissionJune 27, 2023…

Read Blog Detail

By Ethan Rohrbach “3000 SE Powell Boulevard” is the name of Home Forward’s…

Read Blog Detail

By John A. Charles, Jr. Over the next four weeks, the Oregon legislature…

Read Blog Detail

By John A. Charles, Jr. Over the next five weeks, the Oregon legislature…

Read Blog Detail

By Eric Fruits, Ph.D. In about 18 months, Portland-area drivers will be paying…

Read Blog Detail

Eric Fruits, Ph.D.Cascade Policy Institute Submitted to theOregon Department of TransportationApril 6, 2023…

Read Blog Detail

By Eric Fruits, Ph.D. In about 18 months, Portland-area drivers will be paying…

Read Blog Detail

By John A. Charles, Jr. In 2017, when the Oregon Legislature authorized a…

Read Blog Detail

By Eric Fruits, Ph.D. Last week’s snowstorm was more than a snow-pocalypse, it…

Read Blog Detail

By Eric Fruits, Ph.D. This next week is going to be a big…

Read Blog Detail

By Eric Fruits, Ph.D. What do spy balloons, a state liquor scandal, and…

Read Blog Detail

By Eric Fruits, Ph.D. At the end of last year, the Oregon Environmental…

Read Blog Detail

By Eric Fruits, Ph.D. “We got a full tank of gas, half a…

Read Blog Detail

By Eric Fruits, Ph.D. ‘Tis the season for holiday wishes. And, toward that…

Read Blog Detail

By Eric Fruits, Ph.D. If the Oregon Department of Transportation has its way,…

Read Blog Detail

By Eric Fruits, Ph.D. It’s the day after Election Day and the votes…

Read Blog Detail

By Eric Fruits, Ph.D “What’s the one thing you’d do to fix Oregon?”…

Read Blog Detail

By Mia Tiwana Portland City Council is trying its best to bring electric…

Read Blog Detail

By Eric Fruits, Ph.D. Are you ready to pay a toll to cross…

Read Blog Detail

By Taylor Marks Over-promised and under-delivered. Throughout its 18-year life, TriMet’s Yellow Line…

Read Blog Detail

May 19, 2022 FOR IMMEDIATE RELEASE Media Contacts:Micah PerryOffice: (503) 242-0900Mobile: (303) 330-3855micah@cascadepolicy.org…

Read Blog Detail

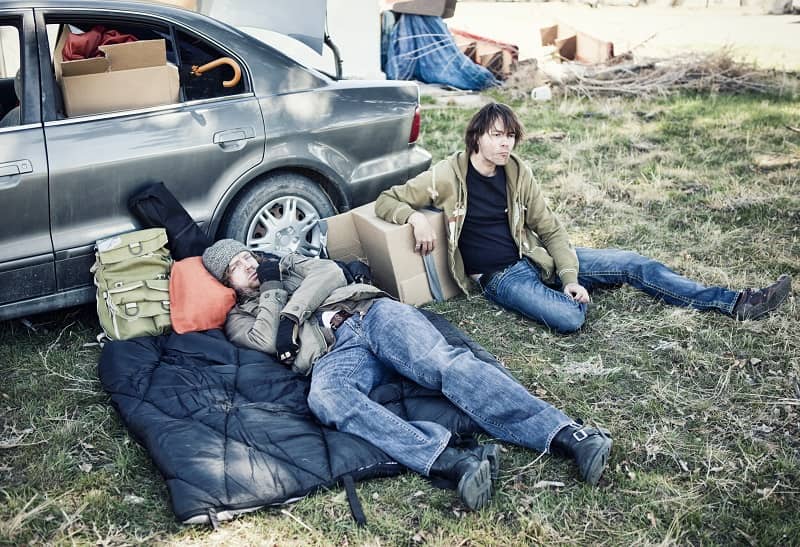

By Micah Perry For years, Portland residents have dealt with homeless individuals parking…

Read Blog Detail

By Micah Perry The Oregon Transportation Commission recently decided how to allocate $412…

Read Blog Detail

By Eric Fruits, Ph.D. With the retirement of Bob Stacey earlier this month,…

Read Blog Detail

By John A . Charles, Jr.TO: Metro Transportation Planning DepartmentFM: John A. Charles,…

Read Blog Detail

By Rachel Dawson Oregon elected officials and appointed staff love to claim they…

Read Blog Detail

By Eric Fruits, Ph.D. Apparently, “COVID time” is a real thing. A week…

Read Blog Detail

Light rail has problems with reliability despite massive government funding. By Stew Robertson…

Read Blog Detail

The “No More Freeways” mantra is extending Portland’s worst bottleneck By Vlad Yurlov…

Read Blog Detail

The Portland metro region tried everything to reduce automobile reliance. It’s time to…

Read Blog Detail

By John A. Charles, Jr. President Trump is not the only one refusing…

Read Blog Detail

By Rachel Dawson Where are all the electric cars in Oregon? If you…

Read Blog Detail

By Rachel Dawson Want to help a low-income individual prosper economically? Give them…

Read Blog Detail

By Vlad Yurlov Metro is expected to spend over $1.4 billion this fiscal…

Read Blog Detail

Oregon’s Business Community Is Challenging the $7.8 Billion Measure By Vlad Yurlov After…

Read Blog Detail

By John A. Charles, Jr. Last month, the Metro Council voted to send…

Read Blog Detail

By Eric Fruits, Ph.D. On July 24th, the New York Times ran a…

Read Blog Detail

By Rachel Dawson TriMet’s weekly system boardings were down 68% in May compared…

Read Blog Detail

By Eric Fruits, Ph.D. While much of the region is stuck at home…

Read Blog Detail

By Rachel Dawson When it comes to commuting during COVID-19, private vehicles are…

Read Blog Detail

By Eric Fruits, Ph.D. Last week, the Oregon Transportation Commission took a significant…

Read Blog Detail

March 9, 2020 FOR IMMEDIATE RELEASE Media Contact: John A. Charles, Jr. (503)…

Read Blog Detail

By John A. Charles, Jr. After eight years of bragging that the proposed…

Read Blog Detail

By Rachel Dawson The Portland Bureau of Transportation (PBOT), the agency charged with…

Read Blog Detail

By Eric Fruits, Ph.D. “It’s time to get this done!” Governor Kate Brown…

Read Blog Detail

By Rachel Dawson Oregon state officials recently celebrated helping the state reach 25,000…

Read Blog Detail

By Rachel Dawson Is it possible to spend billions of dollars on transportation…

Read Blog Detail

By Eric Fruits, Ph.D. How did you get to work today? If you’re…

Read Blog Detail

By Rachel Dawson TriMet has proven time and again that it is unable…

Read Blog Detail

By Rachel Dawson Portland hasn’t seen 50 road fatalities since 1996. With 43…

Read Blog Detail

By Rachel Dawson TriMet’s MAX Yellow Line first opened 15 years ago in…

Read Blog Detail

By Rachel Dawson TriMet may have found a better alternative to the proposed…

Read Blog Detail

By Rachel Dawson Portland’s temporary gas tax should stay just that: temporary. Portland…

Read Blog Detail

By Eric Fruits, Ph.D. “Good in theory, bad in practice.” Sure, it’s a…

Read Blog Detail

By Rachel Dawson TriMet unveiled five new battery-electric buses (BEBs) in April 2019,…

Read Blog Detail

By John A. Charles, Jr. TriMet recently marked the ten-year anniversary of the…

Read Blog Detail

By Micah Perry Driving around Portland could get a lot more expensive. The…

Read Blog Detail

By John A. Charles, Jr. Portland-area motorists who have to regularly cross the…

Read Blog Detail

By John A. Charles, Jr. Portland politicians claim to be concerned about carbon…

Read Blog Detail

By John A. Charles. Jr. Executive Summary Portland has an international reputation for…

Read Blog Detail

June 6, 2019 FOR IMMEDIATE RELEASE Media Contact: John A. Charles, Jr. 503-242-0900…

Read Blog Detail

By Miranda Bonifield TriMet recently announced its first “zero-emission” bus is ready to…

Read Blog Detail

By Eric Fruits, Ph.D. I’ve got a big family, which means we do…

Read Blog Detail

By John A. Charles, Jr. The Portland regional government known as Metro recently…

Read Blog Detail

By Eric Fruits, Ph.D. After teaching an evening class at Portland State University,…

Read Blog Detail

By Miranda Bonifield TriMet’s ridership has been steadily declining in recent years, to…

Read Blog Detail

By Justus Armstrong The Oregon Department of Transportation recently published its Tier 1…

Read Blog DetailFOR IMMEDIATE RELEASE Media Contact: John A. Charles, Jr. 503-242-0900 john@cascadepolicy.org PORTLAND, Ore….

Read Blog Detail

A Proposal for a Pilot Project By Eric Fruits, Ph.D. Summary and recommendation…

Read Blog Detail

By John A. Charles, Jr. Many Portland drivers probably wonder why there are…

Read Blog Detail

By John A. Charles, Jr. The TriMet board recently voted to replace the…

Read Blog Detail

By Justus Armstrong ABC’s Shark Tank may be coming to the Portland region—not…

Read Blog Detail

By John A. Charles, Jr. The TriMet Board recently approved a plan to…

Read Blog Detail

By Jakob Puckett Oregonians have a proud tradition of giving back to distinguished…

Read Blog Detail

By Jakob Puckett Do you need to be protected from your own judgment?…

Read Blog Detail

By Rachel Dawson Decreasing ridership paired with increasing costs makes for a bad…

Read Blog Detail

By John A. Charles, Jr. Oregon employers began receiving notices this week regarding…

Read Blog Detail

By Scott Shepard and John A. Charles, Jr. The Oregon legislature recently adjourned…

Read Blog Detail

By John A. Charles, Jr. February marked the nine-year anniversary of the Westside…

Read Blog Detail

By John A. Charles, Jr. February marked the nine-year anniversary of the Westside…

Read Blog Detail

By John A. Charles, Jr. The Oregon legislature recently adjourned and once again…

Read Blog Detail

By Scott Shepard and John A. Charles, Jr. The Oregon Legislature is currently…

Read Blog Detail

By Scott Shepard Scott Shepard is a lawyer and was a visiting law…

Read Blog Detail

By John A. Charles, Jr. TriMet has been recruiting a new General Manager…

Read Blog Detail

By John A. Charles, Jr. The Oregon Legislature convened again this week. A…

Read Blog Detail

By John A. Charles, Jr. The Oregon Department of Transportation is hosting three…

Read Blog Detail

By John A. Charles, Jr. In November the regional government, Metro, released the…

Read Blog Detail