The Affordable Housing Scam

By Randal O’Toole Executive Summary U.S. taxpayers spend tens of billions of dollars…

Read Blog Detail

By Randal O’Toole Executive Summary U.S. taxpayers spend tens of billions of dollars…

Read Blog Detail

By Karen Rue Last week, Cascade Policy Institute provided suggestions to the Board…

Read Blog Detail

April 3, 2024 Vicki WalkerDirector, Oregon Department of State Lands775 Summer Street NESalem,…

Read Blog Detail

April 2, 2024 Mr. Gary HollandsChair, Portland Public School Board501 N. Dixon StreetPortland,…

Read Blog Detail

By Kathryn Hickok This month, Alabama became the most recent state to increase…

Read Blog Detail

By John A. Charles, Jr. Recently Gov. Tina Kotek decided to pull the…

Read Blog Detail

By Joshua Schutte The Oregonian recently reported that “Oregon students as a whole…

Read Blog Detail

March 12, 2024 Ms. Julie BrownChairOregon Transportation Commission355 Capitol Street NESalem, OR 97301…

Read Blog Detail

By John A. Charles, Jr. On February 22, the Joint Committee on Transportation…

Read Blog Detail

By John A. Charles, Jr. The 35-day session of the Oregon Legislature opened…

Read Blog Detail

John A. Charles, Jr.President & CEOFebruary 7, 2024 Cascade’s mission is to promote…

Read Blog Detail

By John A. Charles, Jr. During the holidays, the Oregon Department of Energy…

Read Blog Detail

By John A. Charles, Jr. Last week Gov. Tina Kotek released the recommendations…

Read Blog Detail

By John A. Charles, Jr. At the Portland Public Schools board meeting last…

Read Blog Detail

November 29, 20323 Metro Council600 NE Grand AvenuePortland, OR 97232 Re: Adoption of…

Read Blog Detail

By John A. Charles, Jr. In any prolonged strike, it is usually assumed…

Read Blog Detail

By Mia Tiwana The homeschool landscape is changing. Our approach to school funding…

Read Blog Detail

By Mia Tiwana It’s time to end home equity theft in Oregon. In…

Read Blog Detail

By Kathryn Hickok A long-standing question about taxpayer-funded school choice programs like vouchers,…

Read Blog Detail

By Kathryn Hickok North Carolina has become the ninth state to enact universal…

Read Blog Detail

September 19, 2023 Re: Agenda Item 798—Portland Clean Energy Community Benefits Fund (PCEF)…

Read Blog Detail

By John A. Charles, Jr. In 2018, local voters approved the creation of…

Read Blog Detail

By Kathryn Hickok 2023 has been an outstanding year for school choice. Utah,…

Read Blog Detail

By Kathryn Hickok A June 2023 RealClear Opinion Research survey of registered voters…

Read Blog Detail

By Micah DeSilva For over 40 years, Oregon has outlawed the construction of…

Read Blog Detail

By Micah DeSilva Earlier this year, Oregon lawmakers proposed legislation allowing voters to reconsider their 1980 decision to effectively ban construction of new nuclear…

Read Blog Detail

By Micah DeSilva Metro is the regional government of the greater Portland region….

Read Blog Detail

By Micah DeSilva Two years ago, the Oregon Legislature passed House Bill 2021,…

Read Blog Detail

By John A. Charles, Jr. In June the elected Auditor for Metro published…

Read Blog Detail

By Sam Herrin Two weeks ago, Portland Mayor Ted Wheeler announced plans to…

Read Blog Detail

By John A. Charles, Jr. Just four days before legislative adjournment, House Bill…

Read Blog Detail

By Kathryn Hickok Three states recently expanded education options for K-12 students through…

Read Blog Detail

By John A. Charles, Jr. Most Republican members of the Oregon Senate have…

Read Blog Detail

By Sam Herrin “More money, same result” is what Oregon’s Senate voted for…

Read Blog Detail

By John A. Charles, Jr. The Oregon Senate has come to a standstill…

Read Blog Detail

By John A. Charles, Jr. Over the next four weeks, the Oregon legislature…

Read Blog Detail

By John A. Charles, Jr. Over the next five weeks, the Oregon legislature…

Read Blog Detail

By Eric Fruits, Ph.D. If you’re a Multnomah County homeowner, business owner, or…

Read Blog Detail

By Eric Fruits, Ph.D. Elected officials across the state are scrambling to do…

Read Blog Detail

By Eric Fruits, Ph.D. In about 18 months, Portland-area drivers will be paying…

Read Blog Detail

By Eric Fruits, Ph.D. While Oregonians are filling out their tax returns, their…

Read Blog Detail

Eric Fruits, Ph.D.Cascade Policy Institute Submitted to theOregon Department of TransportationApril 6, 2023…

Read Blog Detail

By Eric Fruits, Ph.D. Oregon’s economic engine is losing steam. For the second…

Read Blog Detail

By Eric Fruits, Ph.D. In about 18 months, Portland-area drivers will be paying…

Read Blog Detail

By Eric Fruits, Ph.D. The moral crisis over vaping has hit the Oregon…

Read Blog Detail

By Eric Fruits, Ph.D. Last week’s snowstorm was more than a snow-pocalypse, it…

Read Blog Detail

By Eric Fruits, Ph.D. This next week is going to be a big…

Read Blog Detail

By Eric Fruits, Ph.D. What do spy balloons, a state liquor scandal, and…

Read Blog Detail

February 9, 2023 FOR IMMEDIATE RELEASE Cascade Policy Institute4850 SW Scholls Ferry Rd.,…

Read Blog Detail

By Eric Fruits, Ph.D. My, how time flies. Just last month, I warned…

Read Blog Detail

By Eric Fruits, Ph.D. “We got a full tank of gas, half a…

Read Blog Detail

By Eric Fruits, Ph.D. ‘Tis the season for holiday wishes. And, toward that…

Read Blog Detail

By Eric Fruits, Ph.D. If the Oregon Department of Transportation has its way,…

Read Blog Detail

By Eric Fruits, Ph.D. First they banned styrofoam, then last week they banned…

Read Blog Detail

By Eric Fruits, Ph.D. Portland is a world leader in magical thinking on…

Read Blog Detail

By Eric Fruits, Ph.D. It’s the day after Election Day and the votes…

Read Blog Detail

By Eric Fruits, Ph.D “What’s the one thing you’d do to fix Oregon?”…

Read Blog Detail

By Eric Fruits, Ph.D. Last week, Portland Mayor Ted Wheeler and his council…

Read Blog Detail

By Eric Fruits, Ph.D. This week, Portland City Council is considering five resolutions…

Read Blog Detail

By Eric Fruits, Ph.D. Yet again, Metro is asking for more money for…

Read Blog Detail

By Eric Fruits, Ph.D. For most of us, homeless tents blocking sidewalks are…

Read Blog Detail

By Eric Fruits, Ph.D. The ballot for November’s election is filling up, and…

Read Blog Detail

By Eric Fruits, Ph.D. If you feel like Oregon politicians are spending more,…

Read Blog Detail

By Eric Fruits, Ph.D. It seems everywhere you look, “clean energy” is in…

Read Blog Detail

By Eric Fruits, Ph.D. It seems everywhere you look, “clean energy” is in…

Read Blog Detail

By Taylor Marks In 2014, Fire Station 21, located on SE Madison St….

Read Blog Detail

By Mia Tiwana Connecticut’s bus service just pulled its entire fleet of electric…

Read Blog Detail

By James Swyter and Mia Tiwana This month, Portland City Council approved $118…

Read Blog Detail

By Eric Fruits, Ph.D. Things are not going well in the Portland region….

Read Blog Detail

By Mia Tiwana Have you heard of the Portland Clean Energy Fund? Portlanders…

Read Blog Detail

By Eric Fruits, Ph.D. Two of my kids are young adults working retail….

Read Blog Detail

By Taylor Marks Too much, all at once. Portland’s city charter is long…

Read Blog Detail

By Eric Fruits, Ph.D. Last week, an Oregonian story reported that for years,…

Read Blog Detail

By Mia Tiwana Portland City Council is trying its best to bring electric…

Read Blog Detail

By Eric Fruits, Ph.D. It’s budget season for local governments in Oregon. Budgets…

Read Blog Detail

May 24, 2022 FOR IMMEDIATE RELEASE Media Contacts: Eric Fruits, Ph.D.Office: (503) 242-0900eric@cascadepolicy.org…

Read Blog Detail

By Eric Fruits, Ph.D. and Mia Tiwana Executive Summary In November 2020, Portland…

Read Blog Detail

By John A. Charles, Jr. State Representatives Karin Power (Milwaukie), Anna Williams (Hood…

Read Blog Detail

By Micah Perry According to a revised report from economic consulting firm ECONorthwest,…

Read Blog Detail

By Eric Fruits, Ph.D. For more than a year, Cascade Policy Institute has…

Read Blog Detail

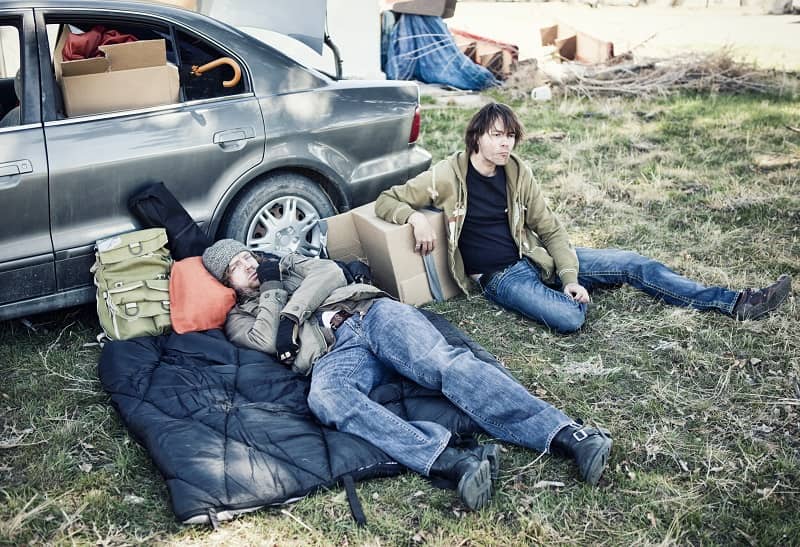

By Micah Perry For years, Portland residents have dealt with homeless individuals parking…

Read Blog Detail

By Eric Fruits, Ph.D. The Census just released the latest population estimates and,…

Read Blog Detail

By John A. Charles, Jr. Many Oregon politicians have convinced themselves that we…

Read Blog Detail

By Eric Fruits, Ph.D. This time they’re coming for your home. Earlier this…

Read Blog Detail

By Eric Fruits, Ph.D. Just five months ago, Portland City Council announced that…

Read Blog Detail

By Micah Perry Everyone loves getting a raise. Our Oregon state legislators are…

Read Blog Detail

By Eric Fruits, Ph.D. People in the Portland area love their parks and…

Read Blog Detail

By Rachel Dawson Think the natural gas industry is dying? The latest data…

Read Blog Detail

He Had the Right Approach on Homelessness By Eric Fruits, Ph.D. Fewer than…

Read Blog Detail

By Rachel Dawson A recent poll by the Portland Business Alliance found that…

Read Blog Detail

By Micah Perry In December 2021, Metro, the Portland-area regional government, opened Newell…

Read Blog Detail

By Rachel Dawson With the start of a new year, power customers will…

Read Blog Detail

By Eric Fruits, Ph.D. Just after dinner on New Year’s Eve, my oldest…

Read Blog Detail

By Eric Fruits, Ph.D. What if everything we thought we knew about homelessness…

Read Blog Detail

By Micah Perry It’s been more than six years since Portland declared a…

Read Blog Detail

By Micah Perry In a recent November special election, Lincoln County approved a…

Read Blog Detail

By Rachel Dawson Governor Kate Brown has joined other state and national representatives…

Read Blog Detail

By Eric Fruits, Ph.D. With the retirement of Bob Stacey earlier this month,…

Read Blog Detail

By Rachel Dawson Just over a year ago the Portland City Council cut…

Read Blog Detail

By Micah Perry Over the course of more than 25 years, Metro’s parks…

Read Blog Detail